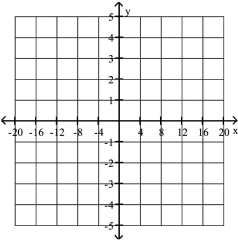

Graph the inequality.

-

Definitions:

Laffer Curve

A theory that suggests there exists an optimal tax rate which maximizes government revenue without deterring economic growth, demonstrating the trade-off between tax rates and taxable income.

Tax Rates

Tax rates are the percentages at which an individual or corporation is taxed, varying by income level, economic activity, or type of good.

Tax Revenues

The financial earnings governments receive through taxing.

Discretionary Economic Policy

Economic policies that are based on the judgment and decisions of policymakers rather than set by predefined rules or automatic mechanisms.

Q28: <span class="ql-formula" data-value="| x | - y

Q35: In the town of Milton Lake, the

Q48: <span class="ql-formula" data-value="x + 2 y +

Q82: <span class="ql-formula" data-value="\log _ { \mathrm {

Q84: <span class="ql-formula" data-value="\begin{array} { l } (

Q87: <span class="ql-formula" data-value="4 ^ { ( 7

Q96: You have 60 feet of fencing to

Q174: The value of a particular investment

Q205: <span class="ql-formula" data-value="\text { Use the graph

Q250: <span class="ql-formula" data-value="\log _ { 6 }