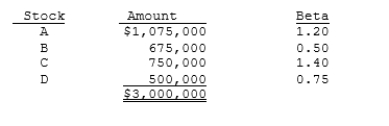

Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund?

Definitions:

Contaminated

Subjected to the introduction of pollutants or undesirable substances, making something impure or hazardous.

Porosity

The measure of how much of a rock is open space, which could be filled by liquids or gases.

Igneous Rocks

Geological formations that originate from the solidification and cooling of molten rock materials.

Porosity

The measure of empty spaces in a material, indicating its ability to hold fluid.

Q1: Which of the following statements is CORRECT?<br>A)

Q1: An option that gives the holder the

Q2: Which of the following statements is CORRECT?<br>A)

Q10: The two basic types of hedges involving

Q21: Schalheim Sisters Inc. has always paid out

Q26: Other things held constant, the value of

Q27: Which of the following statements regarding a

Q29: In a portfolio of three different stocks,

Q30: According to the MM extension with growth,

Q53: Suppose you borrowed $12,000 at a rate