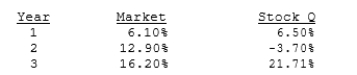

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

Definitions:

Dividends

Profits paid out by a company to its stockholders, frequently as a distribution of earnings.

Asset Account

An account on a company's balance sheet that represents the resources owned by the company that have economic value.

Liability Account

An account on the balance sheet indicating obligations or amounts owed to others that will require a future outlay of resources.

Recording

The process of documenting financial transactions in the accounting records.

Q25: Corporations that invest surplus funds in floating-rate

Q30: Companies with relatively high assets-to-sales ratios require

Q32: The rate used to discount projected merger

Q45: Which of the following would be most

Q45: Exchange rate quotations consist solely of direct

Q46: Schnusenberg Corporation just paid a dividend of

Q72: Assume that interest rates on 20-year Treasury

Q91: The payment made each period on an

Q121: Stock X has a beta of 0.5

Q129: Suppose you are buying your first condo