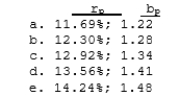

Assume that you hold a well-diversified portfolio that has an expected return of 12.0% and a beta of 1.20. You are in the process of buying 100 shares of Alpha Corp at $10 a share and adding it to your portfolio. Alpha has an expected return of 15.0% and a beta of 2.00. The total value of your current portfolio is $9,000. What will the expected return and beta on the portfolio be after the purchase of the Alpha stock?

Definitions:

Price Ceiling

A legal maximum price that can be charged for a good or service, typically set by government to protect consumers.

Price Floor

A government or regulatory imposed minimum price above the equilibrium price, preventing prices from dropping too low.

Usury Laws

Regulations designed to protect consumers by capping the interest rate that lenders can charge on credit.

Loanable Funds

The supply of money that savers have made available to borrowers.

Q3: Which of the following statements is most

Q16: Suppose you borrowed $14,000 at a rate

Q18: The Ramirez Company's last dividend was $1.75.

Q25: Assume an economy in which there

Q37: Which of the following are legal and

Q46: Synergistic benefits can arise from a number

Q47: Your aunt has $500,000 invested at 5.5%,

Q48: Stocks A and B each have an

Q49: Which of the following actions would be

Q62: Your uncle is about to retire, and