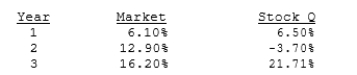

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

Definitions:

Core Values

Fundamental beliefs or guiding principles that dictate behavior and action within an organization, influencing its culture and decisions.

How the Mighty Fall

A framework or study analyzing the stages through which a successful organization or individual declines, often due to complacency or hubris.

Poor Money Management

refers to the inefficient handling of finances, including failures in budgeting, spending, saving, and investing, leading to financial instability.

Organizational Justice

Type of justice that is composed of organizational procedures, outcomes, and interpersonal interactions.

Q1: Which of the following statements is NOT

Q4: Speculative risks are symmetrical in the sense

Q22: Which of the following statements is CORRECT?<br>A)

Q24: Suppose Leonard, Nixon, & Shull Corporation's projected

Q25: Since the primary rationale for any operating

Q41: Agarwal Technologies was founded 10 years ago.

Q62: Your uncle is about to retire, and

Q83: The maturity matching, or "self-liquidating," approach to

Q88: Steve and Ed are cousins who were

Q90: Time lines cannot be constructed for annuities