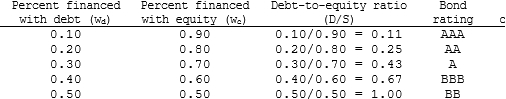

Aaron Athletics is trying to determine its optimal capital structure. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: The company uses the CAPM to estimate its cost of common equity, rs.

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure?

Definitions:

Labour

The human effort, both physical and mental, used in the production process.

Competitive Bidding

A purchasing process in which suppliers submit bids to win the rights to fulfill a contract.

Bid Price

The price a buyer is willing to pay for a good, service, or financial instrument.

Incremental Costs

Costs that change with the level of output or activity, directly associated with a specific business decision.

Q1: Which one of the following aspects of

Q2: Suppose Yon Sun Corporation's free cash flow

Q8: A company seeking to fight off a

Q9: Aaron Athletics is trying to determine its

Q22: Tuttle Buildings Inc. has decided to go

Q47: Currently, Powell Products has a beta of

Q62: Now assume that AJC is considering changing

Q85: Projects S and L both have normal

Q865: What is the name of the geometric

Q867: Given a regular square pyramid, with respect