(The following data apply to Problems 63, 64, and 65. The problems MUST be kept together.)

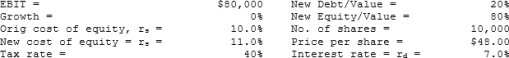

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

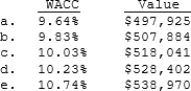

-If this plan were carried out, what would be VF's new WACC and its new value of operations?

Definitions:

Accounts Receivable

Funds that customers owe to a company for products or services already provided but not yet compensated for.

Credit Extension

The act of a lender increasing the amount of credit available to a borrower or the period over which repayment can be spread.

Receivables Financing

A type of financing in which a company uses its accounts receivable as collateral to secure a loan.

Terms of Sale

The conditions under which a seller will complete a sale, typically covering payment terms, delivery times, and warranties.

Q3: Which of the following statements about a

Q7: Which of the following does NOT always

Q8: In the event of bankruptcy under the

Q8: Suppose the December CBOT Treasury bond futures

Q12: Last year Wei Guan Inc. had $350

Q24: P&D Co. has a capital budget of

Q36: Which of the following is NOT one

Q42: Only if a target firm's value is

Q52: Firm M is a mature firm in

Q89: Which of the following is NOT a