(The following data apply to Problems 63, 64, and 65. The problems MUST be kept together.)

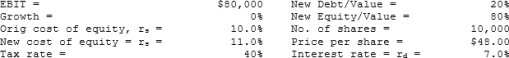

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

-Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

Definitions:

ADHD Treatment

Interventions and strategies aimed at managing symptoms of Attention Deficit Hyperactivity Disorder, including medication, therapy, lifestyle changes, and educational support.

Ritalin

A medication commonly prescribed to treat attention deficit hyperactivity disorder (ADHD) and certain sleep disorders, known chemically as methylphenidate.

Feingold Diet

A dietary plan that eliminates certain artificial colors, flavors, and preservatives to reduce hyperactivity and other behavioral issues in children.

Intensive Psychotherapy

A concentrated and rigorous form of therapy aimed at deeply exploring personal issues, often requiring frequent sessions over a short period of time.

Q8: Suppose hockey skates sell in Canada for

Q14: Suppose the December CBOT Treasury bond futures

Q19: According to the MM extension with growth,

Q34: Ross Financial has suffered losses in recent

Q34: Hindelang Inc. is considering a project that

Q42: Exchange rate risk is the risk that

Q61: The firm's target capital structure should be

Q71: Which of the following statements is CORRECT?

Q77: Maxwell Feed & Seed is considering a

Q96: When considering two mutually exclusive projects, the