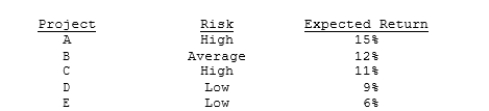

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Re-election

The act of being elected again to a political position that one has previously held.

High Tariffs

High Tariffs are taxes imposed on imported goods to protect domestic industries from foreign competition, raise government revenue, and/or retaliate against unfair trade practices by other countries.

Republican Policies

Policies favored by the Republican Party in the United States, often emphasizing limited government, low taxes, free market capitalism, and a strong national defense.

Plantation Workers

Laborers who work on plantations, historically often under conditions of servitude or slavery, cultivating crops such as sugar, cotton, and tobacco.

Q5: In cash flow estimation, the existence of

Q10: Not-for-profit firms have fund capital in place

Q12: For some firms, holding highly liquid marketable

Q15: What will the after-tax annual interest savings

Q21: The full amount of a lease payment

Q26: Its investment bankers have told Donner Corporation

Q294: Points A, B, C, and D are

Q348: Describe the locus of points in a

Q504: Points A, B, C, and D are

Q865: What is the name of the geometric