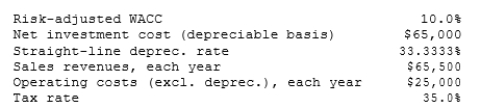

Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

Definitions:

Army Alpha

A historic group-administered intelligence test developed during World War I for the U.S. Army to assess cognitive abilities.

Reaction Time

The amount of time taken to respond to a specific stimulus or task.

Mental Test

A standardized assessment designed to measure a specific aspect of an individual's cognitive abilities or mental functions.

Statistical Manual

A handbook of statistical norms, procedures, and formulas used in data analysis and interpretation in various fields.

Q31: Warnock Inc. is considering a project that

Q36: Other things held constant, which of the

Q36: Which of the following is NOT one

Q39: Assume that PP is considering changing from

Q79: Tuttle Enterprises is considering a project that

Q100: If you were evaluating two mutually exclusive

Q197: In <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="In ,

Q436: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="If

Q480: In order to circumscribe a circle about

Q663: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt=" and