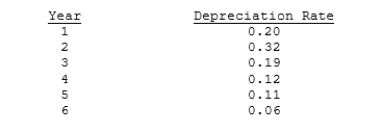

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Definitions:

Short-Run

A period in economics where at least one input is fixed, usually applied to analyze immediate impacts on the economy.

Money Supply

The full quantification of financial means in an economy at a certain point in time, including tangible currency like coins and notes and virtual balances in checking and savings accounts.

Interest Rates

The percentage of a sum of money charged for its use, influencing investment and consumption in the economy.

Investment Spending

Expenditures on new physical capital, such as buildings and machinery, and on inventory investments by businesses, contributing to economic output.

Q9: What is the bond's conversion value?<br>A) $698.15<br>B)

Q14: Which of the following statements is CORRECT?

Q17: The NPV method's assumption that cash inflows

Q20: Blemker Corporation has $500 million of total

Q39: The IRR method is based on the

Q42: Conflicts between two mutually exclusive projects occasionally

Q47: Currently, Powell Products has a beta of

Q124: Since receivables and payables both result from

Q232: A locus of points is the set

Q691: A pyramid has a square base with