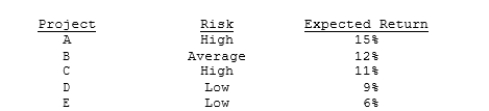

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Endless Chain

A sales technique where current customers are used to generate referrals for future sales opportunities.

Approach Phase

in sales refers to the initial stage of the sales process where a salesperson first makes contact with a prospective customer.

Trial Close

A sales technique where the salesperson presents a question or statement to the potential buyer to gauge their readiness to complete the purchase.

Prospect Pool

A group of potential customers or clients identified as likely to be interested in a company's products or services.

Q8: What would be the incremental cost of

Q13: Which of the following is NOT normally

Q24: A convertible debenture can never sell for

Q31: Volga Publishing is considering a proposed increase

Q35: The NPV method is based on the

Q50: An increase in any current asset must

Q54: Which of the following statements is CORRECT?<br>A)

Q98: For the right rectangular prism (or box)

Q465: For the right triangle with sides of

Q695: How many common tangents do these circles