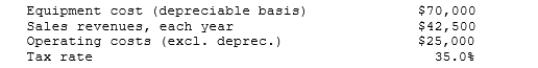

Your company, CSUS Inc., is considering a new project whose data are 1.

Shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33%, 45%, 15%, and 7% for Years

1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 cash flow?

Definitions:

Resources Required

The necessary inputs or assets needed to complete a task, project, or production, including time, money, and materials.

Target Costing

A pricing method that involves subtracting a desired profit margin from a competitive market price to determine allowable production costs.

Cross Functionality

Describes a scenario where individuals or groups from different specialties or departments work together towards a common goal.

Customer Value

The perception of what a product or service is worth to a customer versus the possible alternatives, often influencing their buying decision.

Q17: The NPV method's assumption that cash inflows

Q23: A typical sales forecast, though concerned with

Q32: As a member of UA Corporation's financial

Q36: Assume a project has normal cash flows.

Q49: Which of the following actions would be

Q79: Whitmer Inc. sells to customers all over

Q100: If you were evaluating two mutually exclusive

Q104: You are on the staff of Camden

Q126: Which of the following items should a

Q442: What is the total number of faces