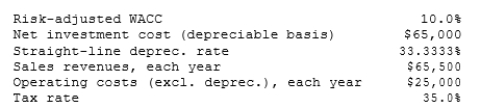

Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

Definitions:

Cognitive Declines

The gradual loss of cognitive abilities, including memory, attention, and executive functions, which can occur as part of the aging process.

MIDUS Study

The Midlife in the United States study, a national longitudinal study of health and well-being that examines the role of behavioral, psychological, and social factors in shaping health across the life course.

Physical Shape

The condition or state of a person's body in terms of fitness, health, and physical appearance.

Emotional Shape

The current state or condition of one's emotional well-being and emotional resilience.

Q9: Which of the following statements is NOT

Q12: If one Swiss franc can purchase $0.71

Q14: Sutton Corporation, which has a zero tax

Q14: Which of the following statements is CORRECT?

Q20: Which of the following statements is CORRECT?

Q37: Which of the following statements is CORRECT?<br>A)

Q52: The primary advantage to using accelerated rather

Q56: The change in net working capital associated

Q393: Points A, B, and C are collinear.

Q772: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="If (not