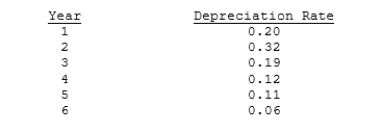

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Definitions:

Price Ceilings

An imposed limit on the price charged for a product or service, often set by government regulation to protect consumers from excessively high prices.

Market Intervention

Market intervention is the action taken by a government or a regulatory authority to affect the market for a particular good or service, typically to correct market failures.

Price Floor

A government- or authority-imposed price control or limit on how low a price can be charged for a product, service, or commodity.

Quantity Supplied

The supply of a product or service that vendors are willing and capable of providing at a specific price during a definite period.

Q3: Midwest Investment Consultants (MIC) operates several stock

Q4: Many preferred stocks extend voting rights to

Q6: Picard Orchards requires a $100,000 annual loan

Q9: For the segment shown, let the center

Q19: Two firms with identical capital intensity ratios

Q24: If the yield curve is upward sloping,

Q74: Moerdyk & Co. is considering Projects S

Q82: For a given polyhedron, there are 24

Q89: Resnick Inc. is considering a project that

Q530: In regular octagon ABCDEFGH, AB = 6.