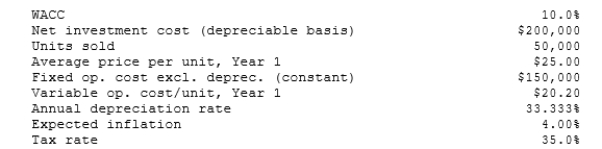

Poulsen Industries is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight- line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required. What is the difference in the expected NPV if the inflation adjustment is made vs. if it is not made?

Definitions:

Q12: Whittington Inc. has the following data. What

Q22: As the text indicates, a firm's financial

Q25: What would be the incremental cost of

Q38: Which of the following events is likely

Q39: As long as a firm does not

Q44: Mortal Inc. expects to have a capital

Q86: The internal rate of return is that

Q168: A right rectangular prism has a base

Q588: The region bounded by chord <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg"

Q831: In a polyhedron, the relationship between numbers