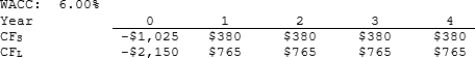

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose?

Definitions:

NPV

Net Present Value; a method used in capital budgeting to evaluate the profitability of an investment or project, calculated by summing the present values of incoming and outgoing cash flows.

Preferred Stock

A security that pays a constant dividend forever. A hybrid between debt and common equity.

Hybrid Security

A financial instrument that combines characteristics of both equity and debt, often providing fixed income or dividends as well as the potential for capital appreciation.

Equity

An ownership interest. The portion of a firm’s capital representing funds belonging to its shareholders. An equity investment is an investment in stock.

Q2: Because "present value" refers to the value

Q5: Wentworth Greenery harvests its crops four times

Q19: If a firm adheres strictly to the

Q19: The calculated cost of trade credit for

Q33: The collection process, although sometimes difficult, is

Q36: Which of the following is NOT one

Q49: Elephant Books sells paperback books for $7

Q335: In a circle in which m <img

Q384: For the right triangular prism shown, the

Q399: In <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="In ,