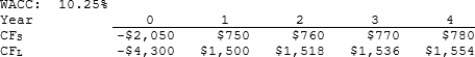

Sexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

Definitions:

Field Servicing

The process of providing maintenance, repair, or support services for products or equipment at the customer's location.

Quality Cost Report

A report that summarizes the costs associated with ensuring products or services meet quality standards, including prevention, appraisal, and failure costs.

Defective Products

Items produced that do not meet the quality standards set by the company or industry, leading to potential returns or losses.

Internal Failure Cost

Costs associated with defects found before a product reaches the customer, including scrap and rework expenses.

Q4: Although it is extremely difficult to make

Q5: Wentworth Greenery harvests its crops four times

Q18: Superior analytical techniques, such as NPV, used

Q18: Firms pay a low interest rate on

Q28: Which of the following statements is CORRECT?<br>A)

Q72: Zarruk Construction's DSO is 50 days (on

Q81: Which of the following statements is CORRECT?<br>A)

Q123: Zervos Inc. had the following data for

Q259: Chords <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="Chords ,

Q908: Point M is the midpoint of <img