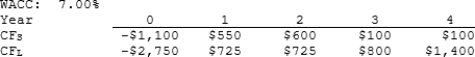

Noe Drilling Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone. In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. MIRR will have no effect on the value lost.

Definitions:

Investments

Assets purchased with the goal of generating income or appreciating in value over time.

Accounting Changes

Accounting Changes are modifications in the accounting methods, estimates, or reporting entity that affect the financial statements of a company.

Net Income

The total earnings of a company after subtracting all expenses from revenues, also known as net earnings or net profit.

Q1: Which of the following statements is CORRECT?<br>A)

Q3: In regular hexagon ABCDEF, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="In

Q6: Which of the following statements is CORRECT?

Q9: Which of the following statements about municipal

Q16: Thoroughbred Industries has been practicing cash management

Q41: Which of the following statements is CORRECT?<br>A)

Q66: Cornell Enterprises is considering a project that

Q299: Quadrilateral ABCD is inscribed in <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg"

Q372: A right pyramid has a rectangular base

Q909: In <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="In ,