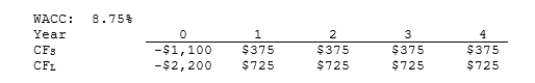

Nast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Retained Earnings

The portion of net income not distributed as dividends but retained by the company for reinvestment or to pay debt.

Cash Dividend

A payment made by a company out of its profits to its shareholders, usually in the form of cash.

Systematic View

An approach that involves a structured, methodical analysis of a problem, situation, or system.

Q7: Which of the following statements about a

Q23: A reverse split reduces the number of

Q28: If sales are seasonal, the days sales

Q34: A circle has the area 126 <img

Q38: If a firm with a positive net

Q51: Which of the following statements is CORRECT?<br>A)

Q63: Romano Inc. has the following data. What

Q87: Which of the following statements is CORRECT?<br>A)

Q190: Which statement is true?<br>A) Any two equilateral

Q206: Find the perimeter of rhombus RSTV in