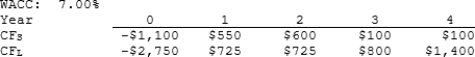

Noe Drilling Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone. In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. MIRR will have no effect on the value lost.

Definitions:

Need to Self-Actualize

A psychological concept referring to the motivation to realize one's own maximum potential and capabilities.

Being Alive

The state or quality of having life, often discussed in the context of what constitutes meaningful or fulfilling existence.

Sociality Corollary

The idea that individuals' identities and behaviors are significantly shaped by their interactions and relationships within social groups and communities.

Constructs

Psychological categories people use to make sense of the world, including various attributes, behaviors, and personality traits.

Q14: Blease Inc. has a capital budget of

Q26: To circumscribe a circle about regular hexagon

Q36: Fauver Worldwide forecasts a capital budget of

Q50: An increase in any current asset must

Q51: Trade credit can be separated into two

Q104: One of the advantages of short-term debt

Q119: Uncertainty about the exact lives of assets

Q152: In a circle of radius length 5,

Q732: Given that each edge measures 4 cm,

Q873: What is the locus of points that