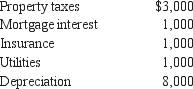

In the current year, Sam Lett purchased a condominium in Hilton Head Island, South Carolina. Sam and his family used the condominium for a total of 30 days. fte condominium was rented out a total of 70 days during the year, generating $9,000 of rental income. Sam incurred the following expenses:

(a.) Determine Sam's deductible expenses using the IRS approach.

(a.) Determine Sam's deductible expenses using the IRS approach.

(b.) How much depreciation can be deducted in the current year if the rental income was $12,000? (c.) Does Sam have any options with regard to the interest and taxes?

Definitions:

April

The fourth month of the year in the Gregorian calendar.

Variable Overhead Efficiency Variance

The difference between actual variable overhead based on the hours worked and the standard variable overhead for the same activity level.

July

The month that is positioned seventh in the Gregorian calendar year.

Raw Materials Quantity Variance

The difference between the actual quantity of raw materials used in production and the standard quantity expected to be used, multiplied by the standard cost per unit of raw material.

Q10: Regulations can be in the form of:<br>A)

Q14: Karen Baker, a cash basis calendar year

Q35: The following table shows the number

Q37: Tax "evasion" and "avoidance" are almost identical

Q45: What is the amount of standard deduction

Q46: <span class="ql-formula" data-value="\text { If } g

Q51: John Jergens, a 45-year-old, is the sole

Q52: Mike, who is single, has $100,000 of

Q68: On July 10, 2008, Test Corporation purchased

Q91: Fines and penalties paid to the government