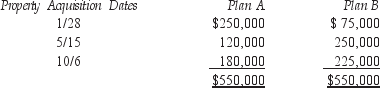

Steve Edwards Enterprises is a sole proprietorship. It is planning to purchase a significant amount of property this year, all of which will be classified as 5-year property for purposes of MACRS depreciation. It would like to know the difference in the total first- and second-year depreciation deductions resulting from the two cost acquisition patterns outlined below: (Ignore bonus depreciation and the Section 179 deduction.)

Definitions:

Characteristic

A feature or quality that distinguishes an individual, group, or thing from others.

Incoming Messages

Messages that are received by a device or individual, as opposed to those being sent out.

Negative Performance Evaluation

An assessment that indicates an employee's work performance does not meet expected standards.

Delivering Negative News

The process of communicating unfavorable information or decisions in a sensitive and thoughtful manner.

Q2: Determine the amount of taxable income of

Q2: What is the general business credit allowed

Q6: John Hughes is in the business of

Q7: Which of the following individuals would most

Q41: Generally, the same valuation principles are used

Q54: Payment of tax is not necessary to

Q74: Malcolm Moore, single, had medical expenses of

Q77: Jim Jeeves is a self-employed individual. During

Q81: The credit for the elderly applies only

Q113: If a debt becomes worthless, the amount