Multiple Choice

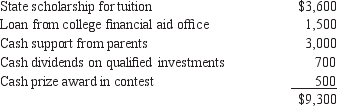

Roger Burrows, age 19, is a full-time student at Marshall College and a candidate for a bachelor's degree. During 2012, he received the following payments:  What is Burrows's adjusted gross income for 2012?

What is Burrows's adjusted gross income for 2012?

Definitions:

Related Questions

Q1: Mr. and Mrs. Garden filed a joint

Q4: In July 1997, Dan Farley leased a

Q8: Dale Davidson's estate includes the following assets:

Q36: The excess of percentage depletion over cost

Q42: fte research and experimental costs the taxpayer

Q44: If the property sold in an installment

Q56: fte manufacturing deduction under Code Section 199

Q60: Both the taxpayer and the government may

Q75: Fees paid to chiropractors may be a

Q82: Information Releases (IRs) usually are not published