Multiple Choice

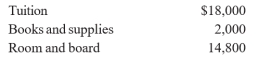

Kevin is a candidate for an undergraduate degree at a local university. During 2012, he was granted a fellowship that provided the following:  What amount can Kevin exclude from gross income in 2012?

What amount can Kevin exclude from gross income in 2012?

Definitions:

Related Questions

Q3: Casualty losses are deductible in the year

Q5: If a qualified pension plan is contributory,

Q8: If the taxpayer is divorced by a

Q14: fte gross estate may differ greatly from

Q28: Henry Hoover operates a freight line which

Q41: What is Jerome Jackson's standard deduction for

Q60: In order to secure prior approval for

Q67: In 2012, Mason Container Co., a calendar

Q83: Child care expenses incurred by a taxpayer

Q119: Nancy Norris gives a painting to a