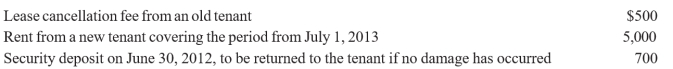

Bob Buttons, a cash basis calendar year taxpayer, owns and operates an apartment building. During 2012, he received the following payments:  What is the amount of Bob's gross rental income for 2012?

What is the amount of Bob's gross rental income for 2012?

Definitions:

Psychosexual Development

A Freudian concept describing how personality development occurs through stages during childhood, each characterized by an erogenous zone and specific conflicts.

Compulsively Neat

Describes a person who has an overwhelming need to keep their surroundings extremely tidy, often driven by anxiety or discomfort when things are out of place.

Resistance

In free association, a blockage or refusal to disclose painful memories.

Medication

Drugs or other substances used to treat or prevent disease or relieve pain.

Q6: Todd is a cash-basis taxpayer. Daren Corporation

Q11: Frank Clarke, an employee of Smithson Company,

Q13: Moving expenses qualify as deductions if:<br>A) the

Q20: On December 28, 2012, Alan Davis died

Q22: Mr. and Mrs. Acres were both over

Q32: Which of the following items is not

Q43: It is possible for one person to

Q45: All estates must file a Form 1041

Q52: Charges, sometimes known as "points," paid by

Q127: If a taxpayer under review disagrees with