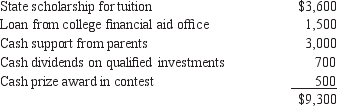

Roger Burrows, age 19, is a full-time student at Marshall College and a candidate for a bachelor's degree. During 2012, he received the following payments:  What is Burrows's adjusted gross income for 2012?

What is Burrows's adjusted gross income for 2012?

Definitions:

Exclusive Agency Contract

A contractual agreement where one party grants another party the exclusive rights to act on their behalf, typically used in real estate and talent management.

Implied Authority

This refers to the power of an agent to perform acts which are reasonably necessary to accomplish the purpose of an organization’s agency agreement, even if not explicitly granted.

Duty of Accounting

The obligation of a party (usually a fiduciary) to keep accurate records and report financial activity to relevant stakeholders or authorities.

Agent Owe

The duty or obligation an agent has to act in the best interest of the principal, including loyalty, care, and full disclosure.

Q4: The temperature in degrees Fahrenheit can be

Q8: Income in respect of the decedent can

Q9: fte following statements about the $13,000 gift

Q16: Which of the following statements is true?<br>A)

Q23: Henry Adams, an unmarried taxpayer, received the

Q24: For a non-qualified distribution from a Roth

Q40: If no one person contributes more than

Q68: A calendar-year corporation incurs $53,000 of start-up

Q70: An investor is not at risk for

Q74: Business depreciable property placed in service prior