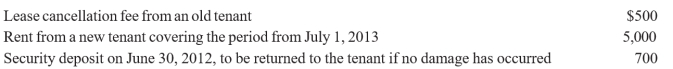

Bob Buttons, a cash basis calendar year taxpayer, owns and operates an apartment building. During 2012, he received the following payments:  What is the amount of Bob's gross rental income for 2012?

What is the amount of Bob's gross rental income for 2012?

Definitions:

Friendly Relations

Positive interactions and connections between individuals or groups characterized by warmth, cooperation, and mutual respect.

Bad-news Messages

Communications tasked with delivering unfavorable information with sensitivity and consideration towards the recipient's perspective.

Denial Messages

Refers to communications that inform recipients about what cannot be done or why a request is rejected, often aiming to maintain a positive relationship.

Proper Tone

The use of language and style in communication that is appropriate for the audience and purpose, reflecting respect and professionalism.

Q2: The following information is available for Ann

Q22: Social security benefits are always included in

Q30: Any preparer who endorses or otherwise negotiates

Q36: Business losses or capital losses incurred by

Q50: Committee reports of the House Ways and

Q52: Sandra Bellows purchased a 15-year annuity for

Q54: Mr. Barley, an accountant, accepted a painting

Q56: Individual taxpayers cannot deduct as itemized deductions

Q73: Section numbers run consecutively through the entire

Q80: Explain why AMT preference items are always