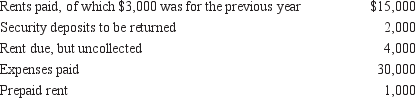

Greg Owens owns a four-flat building. Last year, he recorded the following items:  His gross rental income, depending on whether he is on the cash or accrual basis, amounted to:

His gross rental income, depending on whether he is on the cash or accrual basis, amounted to:

Definitions:

Married Couples

Two individuals legally united in marriage, often recognized by law, culture, or religion, and granted certain legal rights and responsibilities.

Households

Units consisting of one or more people living in the same dwelling and sharing at means such as meals or living accommodation.

Protestant Ethic

A concept in sociology that describes the Calvinist belief in hard work and frugality as means of achieving a person's salvation.

National Culture

The set of shared experiences, beliefs, customs, and values that characterize a country or nation.

Q6: Prior to the Sixteenth Amendment direct taxes

Q8: Art Aubrey owns and operates an apartment

Q11: Frank Clarke, an employee of Smithson Company,

Q12: "Closed Fact" tax research relates to the

Q31: Medical expenses paid by the estate within

Q35: The art of using existing tax laws

Q36: The Internal Revenue Code and IRS revenue

Q40: Given a known elevation at a known

Q55: All of the following income items are

Q66: A like-kind exchange would occur when a