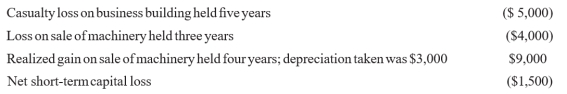

Linda Larsen, single, had the following items during 2012:  Linda had adjusted gross income of $45,000 and $6,000 itemized deductions without the above items.

Linda had adjusted gross income of $45,000 and $6,000 itemized deductions without the above items.

(a.) What is Linda's taxable income for 2012?

(b.) Assuming the same facts as given above except that Linda had a casualty gain of $2,000 on the business building held five years rather than a casualty loss of $5,000, what is Linda's taxable income for 2012?

Definitions:

African-American Males

Refers to males of African descent living in the United States, often discussed in contexts of social, economic, and health disparities.

Violent Crime

Criminal acts that involve force or the threat of force against others, including but not limited to homicide, rape, robbery, and assault.

Implicit Prejudice

Unconscious biases or attitudes toward people or groups without conscious knowledge.

Anti-Gay Prejudice

Negative attitudes, beliefs, or discrimination directed towards individuals who are gay or perceived to be gay.

Q5: fte unified credit is the same for

Q6: A taxpayer whose spouse is covered at

Q15: If named in a decedent's will, a

Q17: Explain the purpose of a block diagram

Q26: What is the general purpose of an

Q32: Tax-exempt organizations generally may establish 401(k) plans

Q37: Give a sample callout for a C

Q51: Draw or sketch a simple block diagram.

Q60: Define conduit.

Q74: In 2012, Tina Turnips gave property with