Use the following information for problems

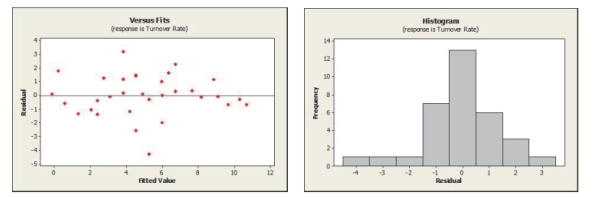

To determine what affects turnover rate, a sample of 33 companies was randomly selected and data collected on the average annual bonus and turnover rate (%). In addition, a questionnaire was administered to the employees of each company to arrive at a trust index (measured on a scale of 0 - 100). Below are the multiple regression results. Dependent Variable is Turnover Rate

Analysis of Variance

-Write out the estimated regression equation.

Definitions:

Conventional Finance Theory

A framework in economics that explains the behavior of financial markets, including the dynamics of assets and securities pricing, investment portfolios, and market mechanisms.

Behavioral Finance

An area of study focusing on how psychological influences and biases affect the financial behaviors of investors and financial markets.

Rational

Characterized by clear, logical thinking, often referring to decision-making that maximizes benefit.

Irrational

Acting without reason or understanding, often defying logical or expected behavior, particularly in economic contexts referring to market participants.

Q2: A 20-year-old woman is at 28 weeks'

Q5: A 28-year-old patient who is pregnant with

Q5: Management at a large multinational corporation would

Q7: Create and interpret a 90% confidence interval.

Q10: The nurse is assessing a newly admitted

Q20: Molly's Reach, a regional restaurant and gift

Q23: By examining residuals, determine which type of

Q38: A researcher is conducting a study on

Q51: A manufacturer of cable wire periodically selects

Q65: Suppose the goal of data mining using