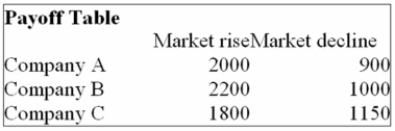

You are trying to decide in which of the three companies you should invest. Refer to the following

Payoff Table.

If the probability of the market declining in the next year is 0.5, which of the following statements

Are correct?

i. The Expected Opportunity Loss for Company A is $120.

ii. The Expected Opportunity Loss for Company B is $75.

iii. The Expected Opportunity Loss for Company C is $200.

Definitions:

Remeasurement

The process of adjusting the carrying value of a financial instrument or asset to reflect its current value or changes in market conditions.

Cash Settlement

A method of settling a transaction or financial instrument in cash rather than the physical delivery of the asset.

Bid Rate

The price at which a buyer is willing to purchase securities or other assets.

Offer Rate

The interest rate at which banks lend to their most credit-worthy customers, often referred to in the context of loans and savings.

Q16: i. The irregular component of a time

Q18: What is the effect on salary for

Q72: A student asked a statistics professor if

Q76: The Federal Aviation Administration reported that passenger

Q96: The chart below can be best described

Q134: For a time series beginning with 1988

Q143: In the equation Y' = a +

Q152: In the regression equation, Y' = a

Q167: Samples of the wires coming off the

Q172: (i. The weekly sales from a sample