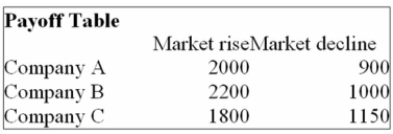

You are trying to decide in which of the three companies you should invest. Refer to the following

Payoff Table.

If the probability of the market declining in the next year is 0.5, which of the following statements

Are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

Definitions:

Capital Gain Distributions

Payments to shareholders or fund investors from the sale of securities within the portfolio that have appreciated in value.

Income Distributions

Payments made from a fund or an entity to its shareholders, often derived from interest or dividend income.

NAV

Net Asset Value, the total value of a fund's assets minus its liabilities, often used to price each share of a mutual fund or ETF.

Capital Gain Distributions

Payments made to mutual fund shareholders from the fund's sale of securities that result in a capital gain.

Q3: (i. The mode is 21.<br>(ii. The arithmetic

Q20: You are trying to decide in which

Q25: Which of the following can be used

Q29: i. The base period for one index

Q29: Considering the chart below, what is the

Q52: Listed below is the average earnings ratio

Q54: A sample of General Mills employees was

Q73: i. The sum of the expected frequencies

Q143: Which of the following measures of dispersion

Q195: (i. The range for laminate flooring is