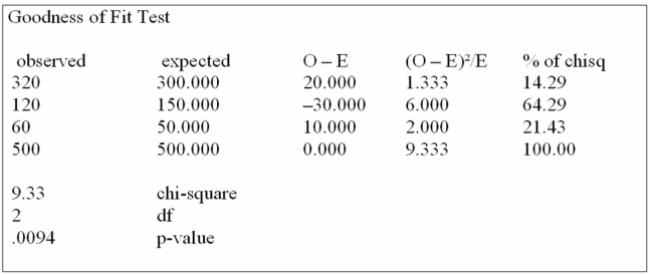

Canadian Accounting classifies accounts receivable as "current", "late", and "not collectible".

Industry figures show that 60% of A/R are current, 30% are late, and 10% are uncollectible. A law

firm in Markham Ontario has 500 accounts receivable: 320 are current, 120 are late and 60 are not

Collectible. Are these numbers in agreement with the industry distribution?

Using the data from this Megastat printout, you determine:

Definitions:

Insurance Proceeds

Funds received from an insurance company as a payout for claims made under an insurance policy.

Life Insurance

A contract between an insurer and a policyholder where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person.

Reformation

The process of modifying a legal document or agreement to correct errors or reflect the true intentions of the parties involved.

Written Insurance Policy

A formal document issued by an insurer that outlines the terms, coverage, and conditions of the insurance agreement.

Q11: i. Social security, old-age pensions, many apartment

Q18: You are trying to decide in which

Q26: The wholesale price of a straight back

Q46: Each person who applies for an assembly

Q59: The Lake Ontario Credit Union selected a

Q72: A manufacturer of automobile transmissions uses three

Q72: Consider the following decision table in which

Q79: The average weekly earnings (including overtime) in

Q145: (i. Correct to two decimal places, the

Q148: The following table shows the number of