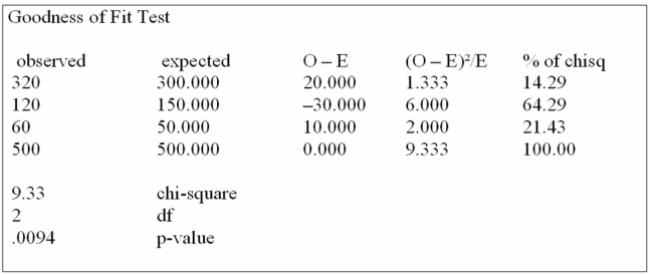

Canadian Accounting classifies accounts receivable as "current", "late", and "not collectible".

Industry figures show that 60% of A/R are current, 30% are late, and 10% are uncollectible. A law

firm in Markham Ontario has 500 accounts receivable: 320 are current, 120 are late and 60 are not

Collectible. Are these numbers in agreement with the industry distribution?

Using the data from this Megastat printout, you determine:

Definitions:

Equity Method

A procedure for accounting for ownership interests, where the investment's carrying amount is adjusted for the investor's proportionate share of the associate company's profits or losses over time.

Investment Account

An account held at a financial institution that holds investments such as stocks, bonds, mutual funds, and other assets for the investor.

Subsidiary

A company controlled by another company, often referred to as its parent company, through ownership of more than half of its voting stock.

Initial Value Method

An accounting approach where an investment is recorded initially at cost, without adjusting for changes in market value over time.

Q1: Refer to the following price of jeans

Q24: What is the class midpoint of the

Q28: The monthly incomes of a small sample

Q59: Listed below is the net sales in

Q64: i. 90% of total variation in the

Q72: A student asked a statistics professor if

Q73: The relationship between interest rates as a

Q95: What is the relative frequency for those

Q156: The ages of all the patients in

Q170: (i. The weekly sales from a sample