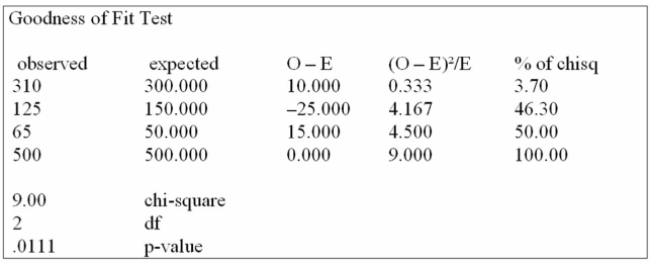

Canadian Accounting classifies accounts receivable as "current", "late", and "not collectible".

Industry figures show that 60% of A/R are current, 30% are late, and 10% are uncollectible. A law

firm in Markham Ontario has 500 accounts receivable: 310 are current, 125 are late and 65 are not

Collectible. Are these numbers in agreement with the industry distribution?

Using the data from this Megastat printout, you determine:

Definitions:

Dividend Yield

A financial ratio that indicates how much a company pays out in dividends each year relative to its share price.

Common Stock

Represents ownership shares in a corporation, giving holders a claim on part of the company’s assets and earnings.

Net Income

Total income of the company after expenses, taxes, and any other costs are deducted from its revenue.

Preferred Dividends

Dividends that are paid to preferred shareholders at a fixed rate before any dividends are paid to common shareholders.

Q15: You are trying to decide in which

Q24: i. One characteristic of the F distribution

Q49: i. Nonparametric tests require no assumptions about

Q50: i. The basic question in testing the

Q76: Listed below is the net sales in

Q97: What is Ln of the forecast for

Q121: i. If there is absolutely no relationship

Q127: (i. The mean is the measure of

Q183: (i. A small manufacturing company with 52

Q194: (i. If the mean of a frequency