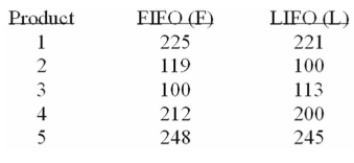

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

What is the decision at the 5% level of significance?

Definitions:

Retroactive Interference

A phenomenon where new memories impair the retrieval of older memories.

High School Classmates

Individuals who are enrolled in the same high school and are members of the same graduating class or year group.

Decay Theory

A theory suggesting that memory fades and becomes less accurate over time due to the mere passage of time, leading information to "decay."

Sensory Memory

The shortest-term element of memory, which allows the retention of impressions of sensory information after the original stimuli have ended.

Q7: The employees at the East Vancouver office

Q15: Three different advertisements were used to sell

Q39: The information below is from the multiple

Q44: A company with $60,000 in current assets

Q48: Barry Company computed the following ratios

Q80: Which item may be of concern when

Q91: The following table shows the number of

Q101: Which of the following events would likely

Q105: When is it appropriate to use the

Q128: It has been hypothesized that overall academic