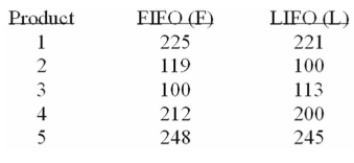

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

What is the decision at the 5% level of significance?

Definitions:

Proteins

Large, complex molecules essential to the structure, function, and regulation of the body's cells, tissues, and organs.

Blood

A vital fluid in organisms that transports necessary substances such as nutrients and oxygen to the cells and carries waste products away.

Thymus Gland

A primary lymphoid organ of the immune system, located in the upper anterior part of the chest cavity, playing a vital role in the development of T cells.

White Blood Cells

Cells of the immune system that help protect the body against infections and foreign invaders, including bacteria, viruses, and parasites.

Q8: What is the critical value for a

Q12: When accounting for investments in trading securities,

Q15: Proitt margin is calculated by dividing<br>A) sales

Q26: The inventory turnover ratio is a measure

Q27: How much does tire production change for

Q40: A national manufacturer of ball bearings is

Q74: Cannalli Landscape Architecture has invested in several

Q84: Ocean Corporation owns 30% of Woods Corp.

Q101: If two samples are used in a

Q118: From RBB's perspective, this is an example