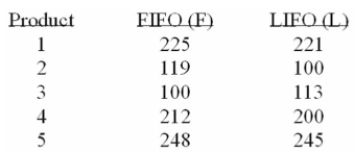

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

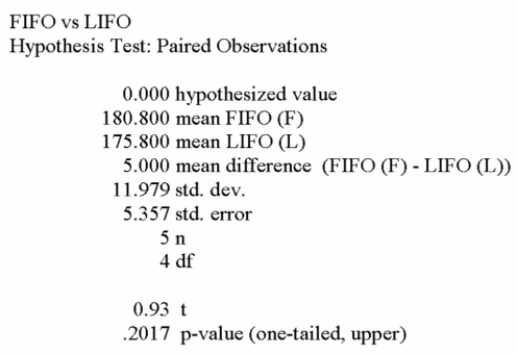

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

What is the decision at the 5% level of significance?

Definitions:

AMT Exemption

An amount exempt from the Alternative Minimum Tax, designed to ensure that taxpayers with higher income pay a minimum amount of tax.

Corporation

A legal entity owned by shareholders, with rights and liabilities distinct from those of its owners, and subject to corporate income tax.

AMT Income

Alternative Minimum Tax income calculates income with different rules than regular taxes, aiming to ensure taxpayers with high income pay a fair share of taxes.

Dividend Income

consists of payments received by shareholders from stocks or mutual funds, representing a share of the profits of the corporation or fund.

Q3: Calculate C Co's return on assets (ROA)

Q17: An electronics company wants to compare the

Q34: A survey reports consumers' preferred brands of

Q37: Which of the following actions would be

Q55: A manufacturer of automobile transmissions uses three

Q59: Accounting procedures allow a business to evaluate

Q70: The best example of a null hypothesis

Q72: i. If the coefficient of correlation is

Q92: Information about management and director compensation would

Q122: If a firm is using financial leverage