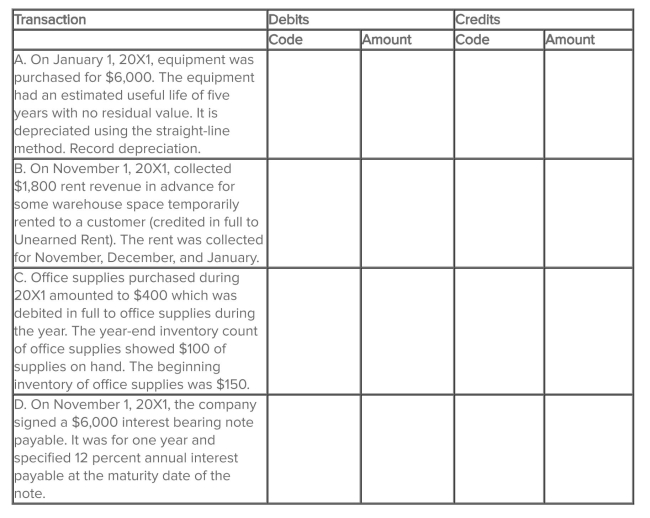

Atlantic Company is completing the information processing cycle at the end of the annual accounting period, December 31, 20X1. Four adjusting entries must be made at this date to update the accounts. The following accounts, selected from Atlantic's chart of accounts, are to be used for this purpose. They are coded to the left for easy reference. You are to indicate the appropriate account code and amount for each required adjusting entry at December 31, 20X1

Definitions:

Plant Size

The physical capacity or output potential of a manufacturing or production facility.

Implicit Cost

The opportunity cost of using resources already owned by the firm for its current purpose, rather than their next best alternative use.

Economic Profits

The surplus remaining after total costs (both explicit and implicit) are subtracted from total revenues, often indicating the financial health and efficiency of a company.

Long-Run Average Cost

The average cost per unit of output where all inputs, including capital, are variable over time, reflecting economies or diseconomies of scale.

Q20: Revenue and expense accounts often are called

Q23: One characteristic of a note receivable is

Q25: At the beginning of 20X2, Rodriguez Corporation

Q29: Cash equivalents are defined as short-term, highly

Q43: Analyze the transactions of the business

Q49: Profit differs from cash flow from operations

Q49: When a company ships products to a

Q74: A payment of a portion of accounts

Q83: Only investments with original maturities of less

Q90: Collection of principal on a note receivable