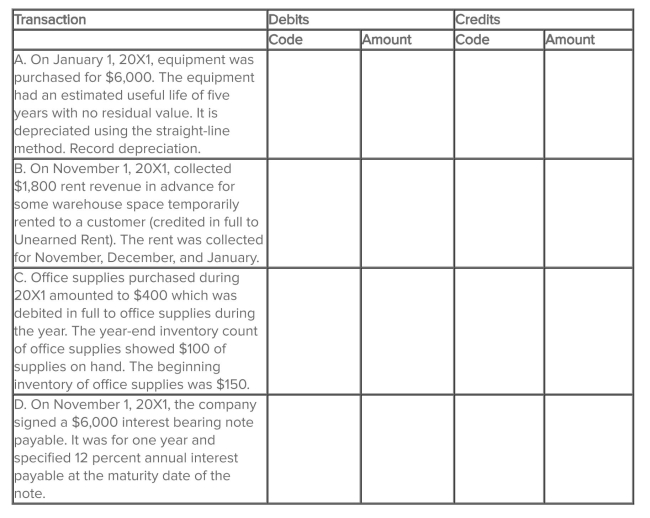

Atlantic Company is completing the information processing cycle at the end of the annual accounting period, December 31, 20X1. Four adjusting entries must be made at this date to update the accounts. The following accounts, selected from Atlantic's chart of accounts, are to be used for this purpose. They are coded to the left for easy reference. You are to indicate the appropriate account code and amount for each required adjusting entry at December 31, 20X1

Definitions:

Dysfunctional Manager

A dysfunctional manager is one who consistently displays behaviors that can negatively impact their team or department, undermining employee morale, productivity, and possibly leading to a toxic work environment.

Supervision Style

The approach or method by which a supervisor guides, motivates, and oversees the performance of their subordinates.

Challenging Tasks

Work assignments or projects that are complex, demanding, and require significant effort and skill to complete.

Action Planning And Follow-Up

The process of defining business strategies and steps, and ensuring their implementation and effectiveness are monitored.

Q2: A 100 ml sample of water is

Q4: Telly Company reported profit in 20X1 of

Q21: If a cheque correctly written and paid

Q45: The indirect method starts with net earnings

Q65: The thin envelope of life that surrounds

Q77: Purchases discounts should be recorded as an

Q100: The capital expenditures ratio (Cash Flow from

Q110: 401 Diner's net sales reported for April

Q113: On June 1, 20X1, Global Services,

Q122: The statement of financial position<br>A) reports the