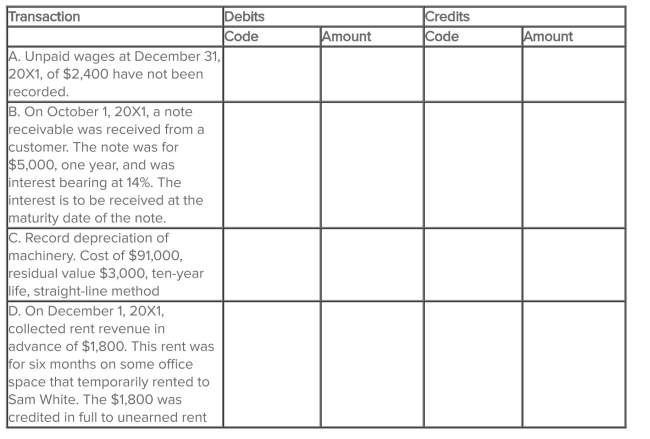

Settler Service is completing the information processing cycle at the end of its annual accounting period, December 31, 20X1. Four adjusting entries must be made to update the accounts. The following accounts, selected from the company's chart of accounts, are to be used for this purpose. They are coded to the left for easy reference. You are to indicate the appropriate account code and amount for each required adjusting entry at December 31, 20X1.

Definitions:

Labor-Force Participation Rates

The share of the labor force within the working-age bracket that is either working or actively searching for work.

Labor-Force Participation Rate

The proportion of the working-age population that is either employed or actively looking for employment.

Unemployment Rate

The percentage of the labor population that is job-free but in active pursuit of employment.

Labor-Force Participation Rate

The portion of the working-age population that is engaged in or seeking employment, including both employed and unemployed individuals.

Q2: The responsibility for keeping the records for

Q2: Which of the following statements about a

Q38: Accrued expenses are<br>A) paid and recorded in

Q49: Profit differs from cash flow from operations

Q56: If C Co.'s trade receivables balance was

Q69: Under the completed contract method, revenue is

Q81: During 20X1, Thomas Company recorded bad debt

Q92: If a customer pays her bill after

Q108: Expenses are the cost of assets consumed

Q124: For each of the following accounts