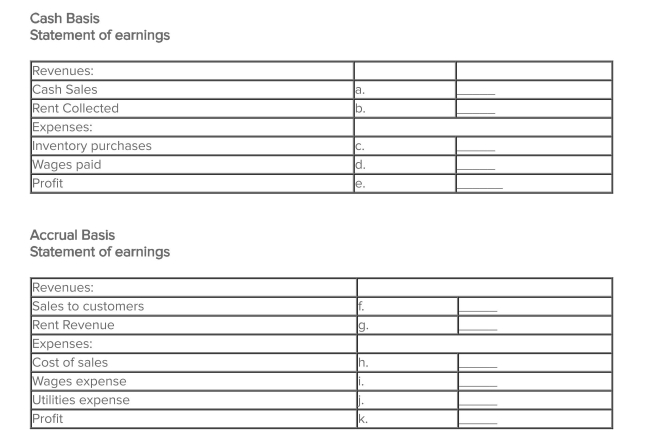

The Upton Country Store had the following transactions in April:

a. Sold $25,000 of goods to customers and received $22,000 in cash and the rest are on account

b. The cost of the inventory sold was $13,000

c. The store purchased $8,000 of inventory and paid for $4, 000 in cash and the rest were bought

on account

d. They paid $7 ,000 in wages for the month

e. Received a $600 bill for utilities for the month that will not be paid until May

f. Received rent for the adjacent store front for the months of April and May in the amount of $3, 000

Complete the following statements:

Definitions:

FICA Tax

Federal Insurance Contributions Act tax, which is a United States federal payroll tax imposed on both employees and employers to fund Social Security and Medicare.

FUTA Tax

Federal Unemployment Tax Act tax, which is a payroll or employer tax paid to fund state workforce agencies.

SUTA Tax

State Unemployment Tax Act tax, which is a payroll tax paid by employers based on the state's unemployment insurance rate and the taxable wage base.

Employee Vacation Benefits

Employee vacation benefits refer to the paid time off provided to employees as part of their compensation package, allowing them time to rest and recharge.

Q21: Biotechnology includes all of the following except

Q47: Which of the following statements regarding gonorrhea

Q75: An adjusting entry to a prepaid expense

Q76: The basic financial statements prepared for external

Q106: In what order are assets are listed

Q110: Identify which of the following accounts appear

Q123: Depreciation expense does not cause a cash

Q129: The net increase (or decrease) in cash

Q131: What are the two categories of shareholders'

Q135: The Town Laundry purchased $5,500 worth of