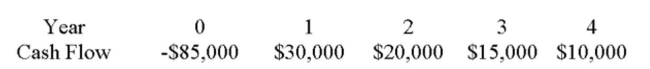

What is the payback period for the following investment?

Definitions:

Marginal Tax Rates

Marginal tax rates are the rates of tax applied to the next dollar of income, used to determine the tax impact of additional income or deductions.

Total Tax

The sum of all taxes levied on an individual or a corporation by various governmental agencies.

Provincial Tax Brackets

These refer to the range of income segments taxed at different rates by provincial governments in countries like Canada, where taxation powers are shared between federal and provincial authorities.

Net Working Capital

The difference between a company’s current assets and its current liabilities, indicating the liquidity of the business.

Q4: INTERNATIONAL TRADE AND DEVELOPMENT From the perspective

Q4: Why doesn't the federal government offer automobile

Q5: If higher federal Spending reduces the unemployment

Q5: INCOME DIFFERENCES List some reasons why household

Q9: ZERO ECONOMIC PROFITS IN THE LONG RUN

Q9: GAME THEORY Suppose there are only two

Q42: Without using formulas, provide a definition of

Q145: Floyd Clymer is the CFO of Bonavista

Q311: The discounted payback rule may cause:<br>A) Some

Q402: Project A has a five-year life and