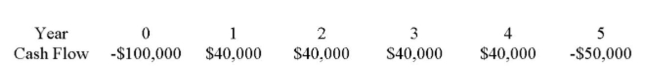

You are considering an investment with the following cash flows. Your required return is 10%, you require a payback of three years and a discounted payback of four years. If your objective is to

Maximize your wealth, should you take this investment?

Definitions:

Phosphates

Inorganic chemical compounds that contain the phosphate ion, fundamental to cellular function and structural frameworks of organisms.

Cellular Respiration

Cellular respiration is the process by which cells generate ATP, the energy currency, by breaking down glucose and other food molecules in the presence of oxygen.

Glucose

A simple sugar that is an important energy source in living organisms and is a component of many carbohydrates.

ATP

Stands for adenosine triphosphate, a molecule that carries energy within cells for metabolism.

Q23: Annmarie is considering a project which will

Q24: The final decision on which one of

Q148: Bill plans to open a do-it-yourself dog

Q178: You are considering two mutually exclusive projects

Q178: The bonds offered by Leo's Pumps are

Q206: Everson Importers has 1,500 shares of common

Q243: The dividend growth model states that the

Q352: The use of the internal rate of

Q365: If the discount rate is 14% and

Q380: Currently, you own 5% of the common