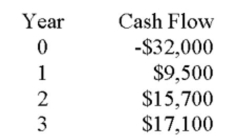

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 14.5 percent? Why or why not?

Definitions:

Financial Ratios

Quantitative measures derived from financial statement analysis used by stakeholders to evaluate a company's financial performance and health.

AFN Formula

The Additional Funds Needed (AFN) formula is used to determine the additional amount of external financing a company will need for future growth and expansion.

Capital Intensity Ratio

The dollar amount of assets required to produce a dollar of sales. The capital intensity ratio is the reciprocal of the total assets turnover ratio.

AFN Formula

The Additional Funds Needed formula, used to calculate the additional working capital required to support a firm's growth in sales.

Q3: When comparing the share of income going

Q17: Average accounting return employs some sort of

Q34: Net present value _.<br>A) Is equal to

Q52: The dividend yield on a common stock

Q138: A 50- year project has a cost

Q238: The initial cost of an investment is

Q297: Often, a firm creates a second class

Q308: You are considering the following projects but

Q340: You have decided that you would like

Q341: The rate at which a stock's price