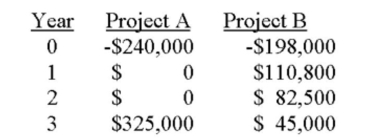

You are considering two mutually exclusive projects with the following cash flows. Will your choice

between the two projects differ if the required rate of return is 8 percent rather than 11 percent? If

so, what should you do?

Definitions:

Profitability Index

A calculation used to assess the attractiveness of an investment, calculated as the present value of future cash flows divided by the initial investment.

Independent Project

A project that can be pursued without affecting the acceptance or funding of other projects, allowing for standalone consideration in decision-making.

Net Present Value

The contrast in the present value of money received and the present value of money spent over a designated duration, applied in capital budgeting to appraise the profitability of a potential investment.

Cash Inflows

Refers to the money received by a business from its various activities, including sales, investments, financing, etc.

Q1: Where has all of the Social Security

Q34: Net present value _.<br>A) Is equal to

Q72: It is more difficult to value a

Q76: The internal rate of return (IRR) is

Q93: Daily Movers is a relatively new firm.

Q137: A zero coupon bond with a face

Q152: If Russian Motors closed at $22 and

Q153: Mother and Daughter Enterprises is a relatively

Q167: List and briefly discuss the advantages and

Q346: The NPV method quickly determines the discount