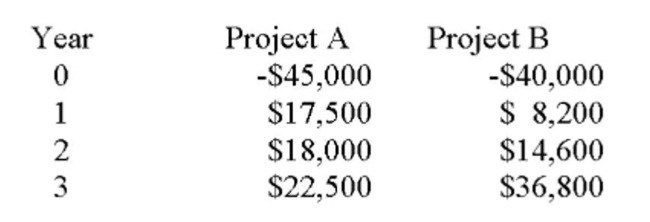

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

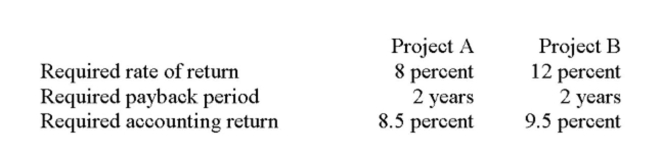

You should accept Project _____ because its net present value exceeds that of the other project by

You should accept Project _____ because its net present value exceeds that of the other project by

_____.

Definitions:

Dividend Payout Ratio

The fraction of net earnings a firm pays to its shareholders as dividends, usually expressed as a percentage.

External Funding

Capital that comes from outside an organization, including bank loans, public offerings, or investments from private entities, used to finance operations, growth, or investments.

Assets/Sales Ratio

A financial metric indicating how much assets a company holds per unit of sales revenue.

Sustainable Growth Rate

The maximum rate at which a company can grow its sales and earnings without increasing its financial leverage or debt financing.

Q3: NEGATIVE EXTERNALITIES Suppose you wish to reduce

Q4: INTERNATIONAL TRADE AND DEVELOPMENT From the perspective

Q6: REPRESENTATIVE DEMOCRACY Major political parties typically offer

Q11: The Home Market has adopted a policy

Q42: Payments made by a corporation to its

Q164: The payback method:<br>A) Entails difficult computations.<br>B) Is

Q186: Without using formulas, provide a definition of

Q192: The payback calculation takes the time value

Q303: An investment is acceptable if its average

Q401: If a company has a current stock