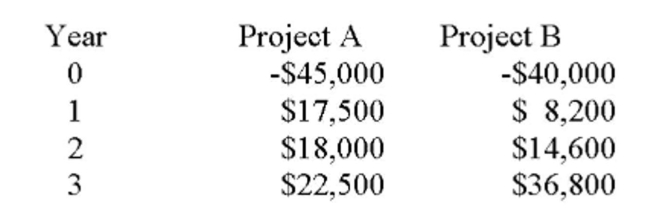

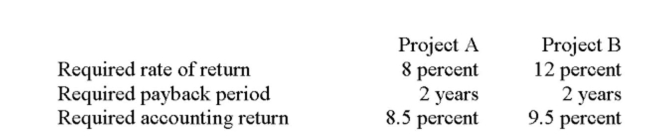

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

You should accept Project _____ because its internal rate of return (IRR) is _____ percent.

You should accept Project _____ because its internal rate of return (IRR) is _____ percent.

Definitions:

Process Costing

A pricing approach applied in production settings, where expenses are allocated to specific processes or departments, ideal for uniform products.

Ending Work

Refers to the final stages of a project or the remaining inventory in production at the end of an accounting period.

Inventory

The raw materials, work-in-process goods, and completely finished goods that are considered to be the portion of a business's assets that are ready or will be ready for sale.

Cost System

A method used by businesses to track, record, and analyze costs associated with production or services.

Q1: If you had the choice of living

Q10: BUREAUCRACY AND REPRESENTATIVE DEMOCRACY A firm is

Q77: The total return on a share of

Q98: A project has a required return of

Q113: A firm seeks to accept projects with

Q119: What is the IRR of an investment

Q152: Complete the following decision rule: A project

Q184: What would you pay for a share

Q318: A dividend on common stock, whether declared

Q381: Simplicity is a relatively new firm that