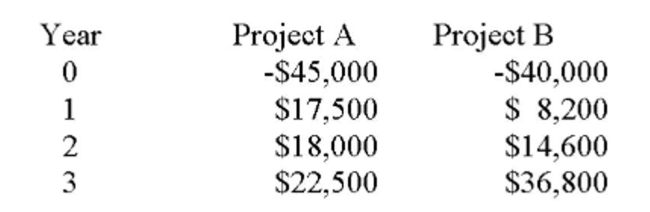

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

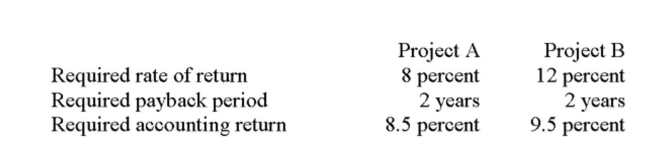

You should accept Project ____ because it has the _____ profitability index of the two projects.

You should accept Project ____ because it has the _____ profitability index of the two projects.

Definitions:

Profit Recognition

The process of reporting income when it is earned and realized or realizable, following accounting principles.

Line-By-Line Method

An accounting technique used in consolidation, where the parent company combines each item of the subsidiary's financial statements with its own, item by item.

Fair Value

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Carrying Amount

The amount at which an asset or liability is recognized in the balance sheet after deducting accumulated depreciation, impairment, and amortization.

Q2: Over the past forty years, growing numbers

Q4: REASONS FOR INTERNATIONAL SPECIALIZATION What determines which

Q5: The term _ is usually applied to

Q66: Latcher's Inc. is a relatively new firm

Q76: Given no change in required returns, the

Q155: Bill plans to open a do-it-yourself dog

Q217: Which of the following is calculated using

Q297: The discount rate that makes the net

Q337: How much are you willing to pay

Q346: The NPV method quickly determines the discount